miércoles, 14 de noviembre de 2012

JUNTAS DE CAUCHO/CORCHO ADUANA USA

On August 6, 1992, this office issued you Headquarters Ruling Letter (HRL) 087392 in which weclassified:Gasket material made of a cork/rubber composite material in subheading 4504.10.1000, HarmonizedTariff Schedule of the United States (HTSUS);Finished gaskets of the above material in subheading 8409.91.9190, HTSUS, (currently provided for inthe 1998 HTSUS under subheading 8409.91.1080) which provides for "[P]arts suitable for use solely orprincipally with the engines of heading 8407 or 8408: Other: Suitable for use solely or principally withspark-ignition internal combustion piston engines (including rotary engines): Other:For vehicles ofsubheading 8701.20, or heading 8702, 8703 or 8704" or, if for compression-ignitioninternal combustion engines of heading 8408, in subheading 8409.91.9990; andFinished gaskets of the above materialfor use in automotive transmissions in subheading 4504.90.2000(currently provided for in the 1998 HTSUS under subheading 4504.90.0000).Upon further consideration, HRL 087392 is deemed to be in error as regards the classification of thecork/rubber gasket material and the finished gaskets.Pursuant to section 625(c)(1), Tariff Act of 1930 (19 U.S.C.1625(c)(1)), as amended by section 623 of Title VI (Customs Modernization) of the North AmericanFree Trade Agreement Implementation Act, Pub. L. 103-182, 107 Stat. 2057, 2186 (1993), notice ofthe proposed revocation of HQ 087392 was published on October 28, 1998, in the Customs Bulletin,Volume 32, Number 43.

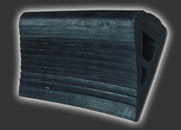

FACTS:Two classes of merchandise are the subject of this revocation:finished gaskets and gasket material insheet or strip form. Both are made of a cork and rubber composite material. The composition of thematerial varies from 60 to 80 percent by weight rubber and 20 to 40 percent by weight cork. The corkand rubber are combined in Portugal and formed into blocks. The blocks are shipped to Canada wherethe importer slices the large pieces into sheets or elongated strips. Some of this material is shipped into theUnited States in sheet or strip form; some is cut to finalshape as gaskets and then imported.

ISSUES:What is the proper classification of the composite cork/rubber gasket material?What is the proper classification of the finished gaskets?LAW AND ANALYSIS:

Classification of merchandise under the HTSUS is governed by the GeneralRules of Interpretation(GRI's). GRI 1 provides that classification shall be determined according to the terms of the headings andany relative section or chapter notes. Merchandise that cannot be classified in accordance with GRI 1 is tobe classified in accordance with subsequent GRI's, taken in order.Classification of the Gasket MaterialIn HRL 087392, this office determined that the subject cork/rubber composite material was classifiable inheading 4504, HTSUS, which provides for "[A]gglomerated cork (with or without a binding substance)and articles of agglomerated cork," by application of GRI 1. In support of this classification, it was notedthat the heading text described the subject material and the Explanatory Note to heading 4504, at page717, described agglomerated cork with a binder of vulcanized rubber.Upon further consideration of this matter, Customs has determined that the rubber component of thesubject material is described by heading 4008, HTSUS, which provides for "[P]lates, sheets, strip, rodsand profile shapes, of vulcanized rubber other than hard rubber." As the subject material is described inequally specific terms by headings 4008 and 4504, HTSUS, classification is pursuant to a GRI 3(b)analysis.GRI 3(b) provides:"(b) Mixtures, composite goods consisting of different materials or made up of different components, andgoods put up in sets for retailsale, which cannot be classified by reference to 3(a), shall be classified as ifthey consisted of the material or component which gives them their essential character, insofar as thiscriterion is applicable."Explanatory Note (EN) VIII to GRI 3(b) states:"[T]he factor which determines essential character will vary as between different kinds of goods. It may,for example, be determined by the nature of the material or component, its bulk, quantity, weight or value,or by the role of a constituent material in relation to the use of the goods."In applying these criteria to the material at issue, it is noted that the rubber component is of greater weightand value than the cork component. Moreover, the rubber component contributes an important function tothe material's end use as a gasket. A gasket is a seal or packing used to make a pipe or other joint air- orfluid-tight. As vulcanized rubber is compressible, it enhances a gasket's ability to maintain a seal whenjoints compress or expand. Vulcanized rubber is also impermeable to gas and liquid, thereby contributingto a gasket's ability to maintain a seal.

Based on the foregoing, Customs views the rubber component as imparting the essential character to thecomposite material. Accordingly, classification is proper in subheading 4008, HTSUS.Classification of the Finished GasketsIn HQ 087392, Customs determined that the gaskets for use in automotive engines were classifiable inheading 8409, HTSUS. Heading 8409 falls within Section XVI of the Nomenclature. Legal Note 1(a) toSection XVI excludes "articles of a kind used in machinery ... of vulcanized rubber other than hard rubber(heading 40.16)." As these gaskets are for use in machinery and are made of vulcanized rubber,classification in heading 8409, HTSUS, is precluded by direction of the Section Note.Similarly, as the gaskets for use in automotive transmissions are made of vulcanized rubber, they are notclassifiable as articles of agglomerated cork in heading 4504, HTSUS.The gaskets at issue in HRL 087392 are made of vulcanized rubber and are thereby classifiable insubheading 4016.93.1050, HTSUS, which provides for "[O]ther articles of vulcanized rubber, other than of a kind used in the automotive goods of chapter 87... Other...

HOLDING:HRL 087932 is hereby revoked.The gasket material is classifiable in subheading 4008.10.0000, HTSUS, which provides for "[P]lates,sheets, strip, rods and profile shapes, of vulcanized rubber other than hard rubber: of noncellular rubber:plates, sheets and strip," dutiable at a rate of 0.7 percent ad valorem.The finished gaskets are classifiable in subheading 4016.93.1050, HTSUS, which provides for "[O]therarticles of vulcanized rubber, other than hard rubber: Other: Gaskets, washers and other seals: Of a kindused in the automotive goods of chapter 87... Other," dutiable at a rate of 2.7 percent ad valorem.In accordance with 19 U.S.C. 1625(c)(1), this ruling will become effective 60 days after its publication inthe Customs Bulletin. Publication of rulings or decisions pursuant to 19 U.S.C. 1625(c)(1) does notconstitute a change of practice or position in accordance with section 177.10(c)(1), Customs Regulations(19 CFR 177.10(c)(1))

EMPRESAS PORTURIAS DE IQUIQUE - ITI Y EPI PRESENTARAN ESTUDIO DE VENTAJAS PARA EL COMERCIO EXTERIOR BOLIVIANO

“La Directora Técnica de la Cámara Nacional de Despachantes de Aduana - CNDA, Alexina Flores Gallegos y el Asesor de ésta dependencia, José Endara Mollinedo, son autores y disertantes del estudio que se presentará en la CAINCO”

El jueves 15 de noviembre a horas 17:30 en el Salón de Convenciones del Centro Empresarial de las Torres CAINCO de la ciudad de Santa Cruz, la empresa Puerto de Iquique Terminal Internacional (ITI), la Empresa Portuaria de Iquique (EPI) y el Instituto Boliviano de Comercio Exterior (IBCE), organizan el Seminario “Derribando Mitos: Iquique una opción real para el Comercio Exterior Boliviano”.

La actividad estará basada en el estudio “Análisis Comparativo para las exportaciones bolivianas a través de los Puertos de Iquique y Arica” realizado a solicitud de Iquique Terminal Internacional (ITI) por la Directora Técnica de la Cámara Nacional de Despachantes de Aduanas, Ing Alexina Flores Gallegos y el Asesor de esta Dirección Lic. José Endará Mollinedo quienes, en base a su vasta experiencia y conocimiento en el área del comercio exterior y las operaciones aduaneras, elaboraron el documento que plantea las ventajas en tiempos y costos para las exportaciones bolivianas a través del Puerto de Iquique.

El estudio realizado por funcionarios de la Cámara Nacional de Despachantes de Aduanas y el Instituto de Comercio Exterior y Aduanas “Angel Rasmussen”, se constituye en la primera oferta de servicios exportables de la entidad representante de los Despachantes de Aduana de Bolivia, que es el sector experto del Comercio Exterior de Bolivia y quienes garantizan al Estado Plurinacional de Bolivia el correcto pago de tributos aduaneros y el cumplimiento de la normativa legal vigente.

Quienes deseen participar de este Seminario de significativa Importancia comercial, pueden realizar la reserva de su participación comunicándose al teléfono 336-2230.

Suscribirse a:

Entradas (Atom)

..bmp)

..jpg)

..jpg)

.jpg)

.gif)

.jpg)

..jpg)

+Stainless+steel+elbow.bmp)

..jpg)

..jpg)

..jpg)

..jpg)

..jpg)

..jpg)

Tablestacas..gif)

.gif)

.bmp)

..jpg)

.jpg)

..jpg)

.jpg)

..jpg)

.gif)

..jpg)

+de+madera+para+vias,sin+impregnar.jpg)

..jpg)

.gif)

..jpg)

+de+oruga.jpg)

+BEL-ART.jpg)

.jpg)

..jpg)

.gif)

..bmp)

.bmp)